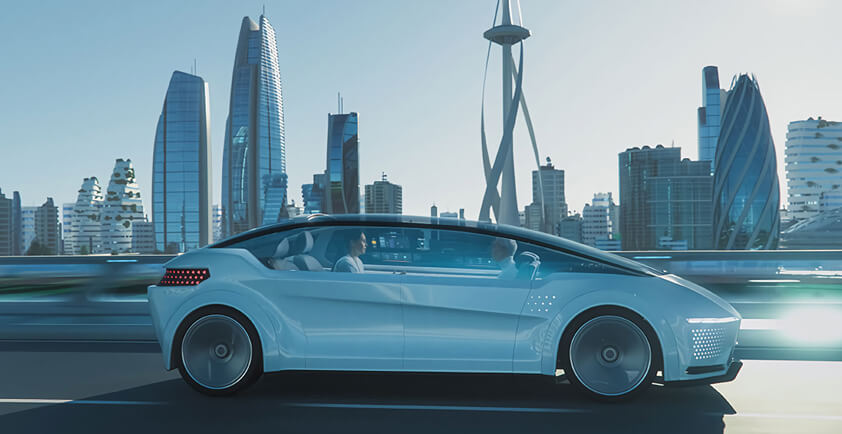

THE CHANGING FACE OF MOBILITY

From Uber to e‑scooters, from delivery drones to flying taxis, mobility and the industries behind it are being shaken up on all fronts.

Of the many megatrends forging the future of our society – and of our company, mobility is one of a handful that we are watching closely. To understand how digitalization is affecting how we get from one place to another and how the entire industry is being reshaped, we sat down with Gina Domanig in her Zurich office at Emerald Technology Ventures. Gina Domanig is a founding partner of the clean‑tech investment fund and member of the board at u‑blox.

How will connected mobility contribute to making the world a better place?

Gina Domanig: One of its main contributions will be safety, regardless of whether cars ever lose their steering wheels. Even if we stop short of that last step, we will still have gained a tremendous amount as a society as all of the features leading along that path will dramatically improve safety. And everybody is interested in safety. The ability for machines to take better decisions than a human, on average, will be a huge safety improvement. We will also see lots of new business models and services, from pay‑as‑you‑use insurance to sharing to predictive maintenance, that are coming out of the convenience, transparency, and fairness trends that are driven by the younger generation. Electrification, whether it’s in automotive, heavy duty vehicles, or marine vessels, will also be a huge trend.

What is behind the ongoing shakeup of the mobility sector?

GD: Our thesis is the car is generating an incredible amount of data – twice as much a human. There’s tremendous value in that. The question is: how will that data be organized, who will gain access to it, and monetize it, and who is responsible for it? As more and more services around transportation and mobility emerge, the value that can be captured out of each vehicle will be much higher than today, even as growth in the number of vehicles slows. This whole topic of value migration is very interesting.

What do you mean by value migration?

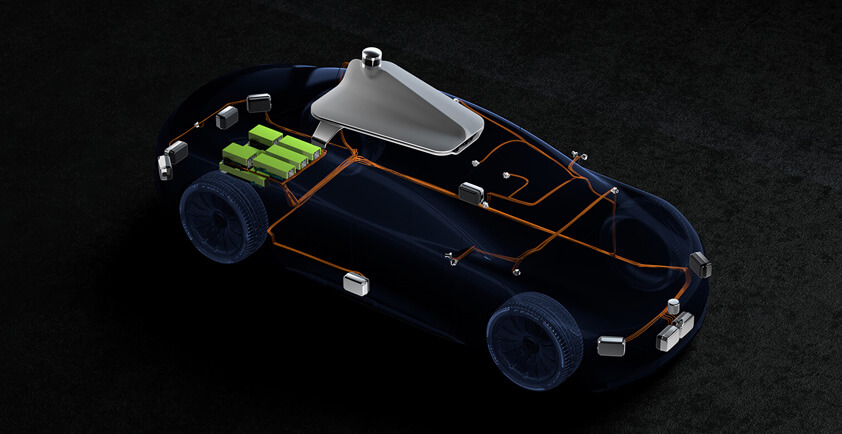

GD: Think about who is earning what kind of margins, and where value is being captured today. Distributors? We can forget about them. Repairs? Electric vehicles don’t need nearly as much repair as internal combustion engine vehicles. We are going to see a change in the value chain, with new parts emerging. So, who is going to be capturing the value? Auto makers? Tech giants? Startups? And how is that going to play out? Some things are clear. For example, the automotive players won’t outsource control over the vehicle itself. But just think about the technologies, products, and services that need to be implemented to have a fully functional autonomous car.

Why don’t automotive companies enter these new niches?

GD: Automotive companies are not X‑as‑a-Service guys, collecting monthly fees for their services isn’t in their DNA. It’s a model the tech companies excel at. That’s why there’s a clash of the worlds right now, as automotive companies are trying to protect themselves from the tech giants, by spending a lot of money to attract talent and buy up startups. Part of it is IP (intellectual property) acquisition, another part is acqui‑hiring: they need to fill their teams with large numbers of AI and sensor fusion specialists. The jury is out as to which players will occupy which part of the value chain going forward. But you have to be bold enough to say that you have as much right to it as they do. Otherwise the tech giants will take over the most lucrative parts of the value chain. They already have you by the phone, and in your home. The only place they don’t have you yet is in your car.

How will things change for consumers?

GD: It will be a much more seamless experience, whether at home, at work, or in the car. The whole issue of software is interesting. Phones were first strongly differentiated, then they became commoditized. Now the differences are in the software, not in the hardware. It will be interesting to observe how that will play out from a consumer point of view. Will people select vehicles based on the applications they host? For the software, the connectivity, or seamlessness? We’re also beginning to see startups offer services that make it easier to jump from one mode of transportation to another. You used to have to own, rent, or borrow a car, drive, then walk the rest of the way. Now, apps give you different variations on how to get to your destination. Pricing between different modes will need to be competitive. It’s a shift that the younger generation will force. They didn’t grow up having to stand in line for tickets. They won’t stand in line for anything.

Do you have any advice for established players in mobility?

GD: Companies need to recognize that they can’t develop everything on their own and instead organize themselves to access innovation outside their own four walls. It isn’t just about mergers and acquisitions, but also about partnerships and open innovation as ways for companies to tap into talent and innovation to prepare themselves for the future. For context: all of the investors in our fund are large corporations, so basically, we are playing the role of facilitating open innovation. And all of them are interested in digitization, for manufacturing, for customers, or to attract the right kind of talent. If they want to develop services with an IT component in them, they need to attract IT workers. Then they are confronted with a different generation, a different culture, and different expectations, and they need to be seen as an attractive employer. Whether they want to or not, they are going to be forced to ride this trend of the new way of working. Especially in newer areas, if today’s established players do not acquire the talent they need to occupy them they will increasingly get marginalized and pushed to the unprofitable parts of the value chain.

How much room is there for partnerships?

GD: A big topic in mobility is functional safety. Here there are several important skills that incumbents can offer that startups do not have. They understand technology adoption. They have relationships with customers. They understand safety standards and how to achieve them. They know how to manage complex supply chains. In areas like these, it’s a very logical thing for incumbents to work with startups.

Read the full article Mobility at the crossroads on p. 12‑16 of the latest u‑blox U magazine, Connected future.