HOW AUTOMAKERS CAN THRIVE IN AN UBERIZED, TECH-DRIVEN FUTURE

How digital technologies are simultaneously redefining the relationship between driver and car, and forcing automakers to transform their manufacturing processes to keep pace.

The automotive industry will face significant challenges in coming years. Drivers and passengers increasingly expect vehicles to connect and interact with the online services they use for business, entertainment, and communication. They also count on access to additional safety and driver-assistance features, while younger consumers often choose car- and ride-sharing over car ownership in many urban environments. Moreover, government regulations around safety, sustainability, and environmental protection are intensifying.

Established automakers must answer two fundamental questions in order to thrive in this new reality:

> Where will they compete along the spectrum of digital services, from entertainment and navigation capabilities to advanced driver-assistance features and fully autonomous vehicles?

> How will they handle the changing relationship between driver and car — from traditional ownership to various models of car- and ride-sharing?

Keys to survival

This 79-page report explores major trends in the automotive industry, and explains how established automakers can survive and thrive despite challenges from consumer trends, intensifying regulations, and aggressive new competitors.

The topics covered include:

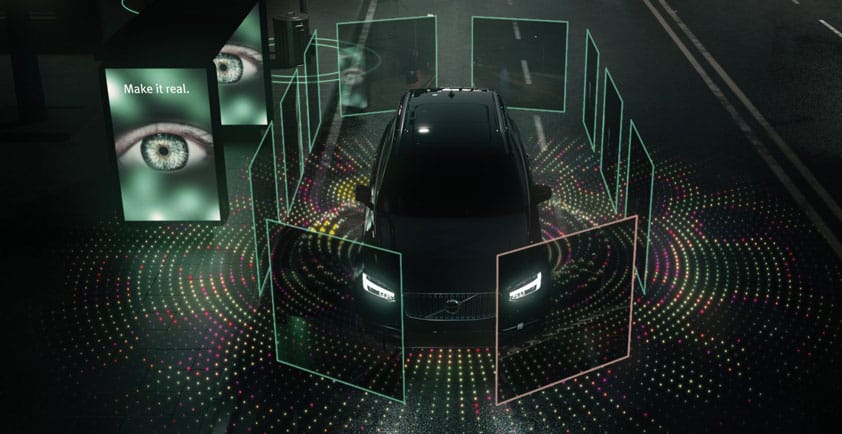

> From transportation to connection. Cars will change from productivity dead zones to digital enablers that connect people to homes, offices, and communities.

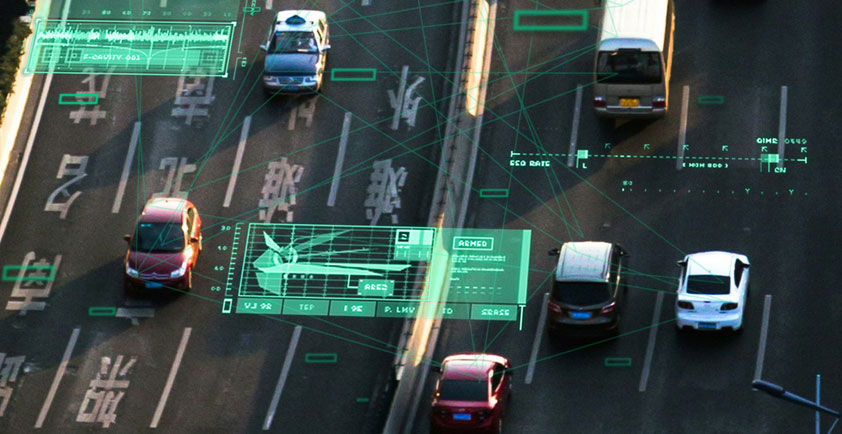

> Safety first for autonomous cars. Fully autonomous vehicles offer unprecedented convenience for travelers, yet raise questions about passenger safety, liability, insurance, and government regulation. Automakers can begin to address safety issues now by expanding the use of advanced driver-assistance systems.

> Not giving up the fossil fuel. Electric vehicles will transform the auto industry, but not as quickly as once believed. Lower oil prices and lighter materials enable consumers to drive more efficient gasoline and diesel engines that meet fuel-consumption ceilings and other regulatory mandates.

> The digital makeover. Automakers must become master integrators of digital systems throughout vehicle designs, assembly lines and supply chains — or watch new entrants drive away with market share.

> Ride-sharing wins over commuters. Ride-sharing and alternative-ownership models could end the auto industry’s 100-year dominance of personal transportation. They could also be a golden opportunity for automakers to provide mobility and transportation services that meet local needs in each country and city.

The auto industry's success will depend on how well it follows the recommendations in this report:

> Embark on a continuous digital path. Automakers will need to include advanced digital technology in their products and throughout their manufacturing processes and supply chains to improve safety, reduce costs, and provide the services that connected consumers want.

> Learn from data. All automakers will need robust big data skills, developed internally and in partnership with tech companies, to gain insights required to execute continual, incremental changes to their businesses and products.

> Partner to provide specialty services. Traditional automakers can leverage expertise in the public, insurance and tech sectors to bring connected vehicles to market quickly and safely in a world of smart cities and connected roads.

> Say goodbye to steel. Lightweight materials and designs can be integrated in cost-effective ways to meet requirements for fuel economy, air quality, and sustainability. Automakers now operate in a world where the next big innovation is only a high-speed network or cloud-based platform away. To succeed, automotive companies can shift into a new, high gear that uses massive computing power to accelerate time to market. That’s a huge course correction for an industry built on horsepower.