IOT AUTOMOTIVE

Mobile networks provide reliable and secure cellular connectivity, meeting different use case requirements of automotive and transport applications.

Key findings

> The automotive industry is expected to be among the top four industries for 5G-enabled service provider opportunity in 2030.

> 4G networks already support massive IoT and broadband IoT, whereas 5G networks will boost broadband IoT performance and enable critical IoT.

> The ongoing and swift roll-out of 5G provides an ideal foundation for a horizontal multi-service network.

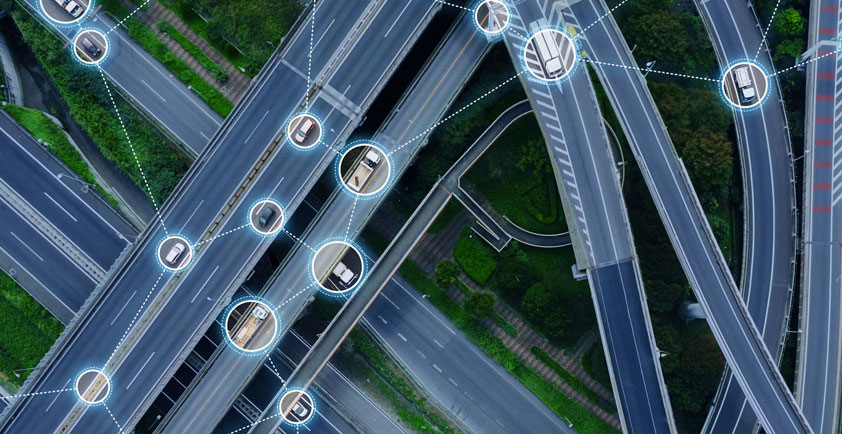

Connected vehicles and road infrastructure are part of a broader IoT ecosystem that is continuously evolving. The automotive industry is expected to be among the top four industries in terms of the 5G-enabled opportunity for service providers in 2030.

The connectivity needs of the automotive and transport ecosystem are diverse and complex, requiring a common network solution, rather than several single-segment solutions. Vehicles can be seen as multipurpose devices in which several connectivity-dependent use cases are executed simultaneously. Deployment of 5G NR, interworking with existing 4G (LTE) networks, can satisfy the connectivity needs for those use cases.

Mixed deployment of 4G and 5G technology

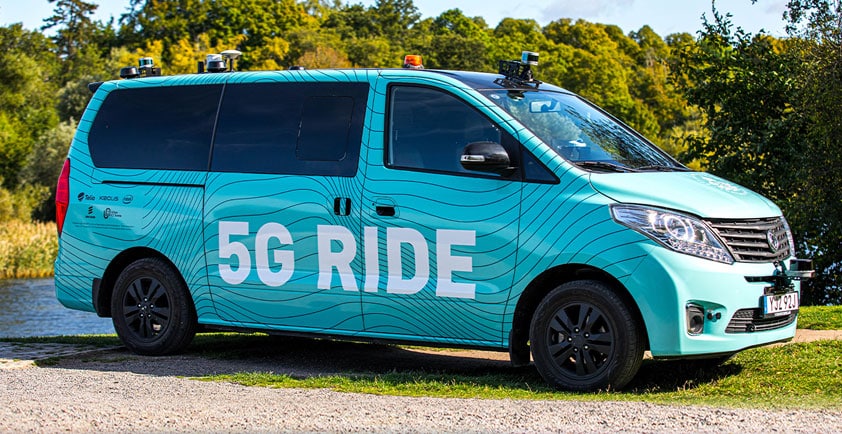

Simulation of a 4G/5G network in a dense urban environment shows that coverage and capacity requirements for automotive services with distinctly different network requirements can be satisfied with a mixed deployment of 4G and 5G technology. Three automotive services with different requirements on user data throughput, latency and resource utilization were applied to the simulated scenario: in-vehicle infotainment (mobile broadband), remote driving (delay-critical), and HD maps and telematics transfer (lower than best effort). The evaluated results show all three services can be supported by the network. The results also show network capacity can be increased at the cost of relaxed delay requirements, such as for services with lower than best effort requirements.

Enabling a full range of automotive services

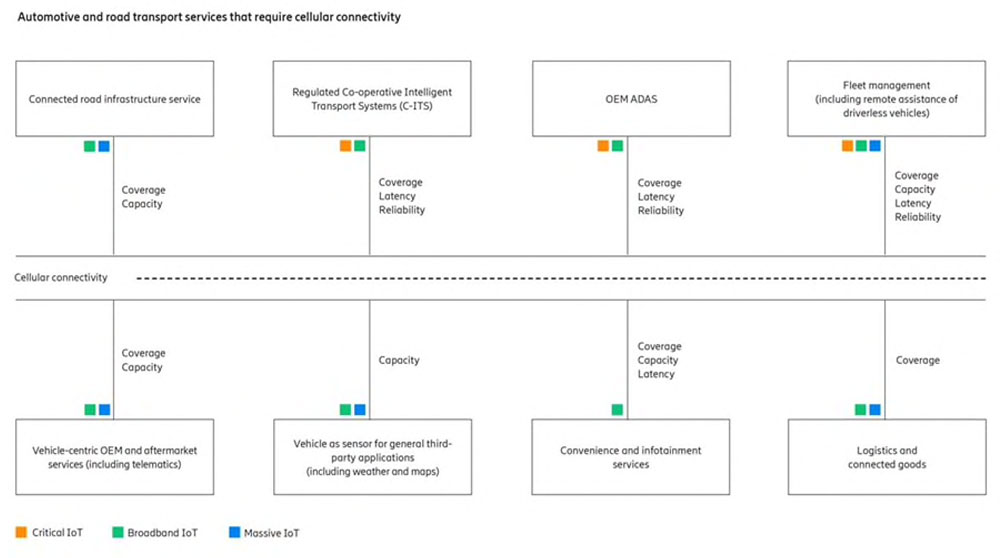

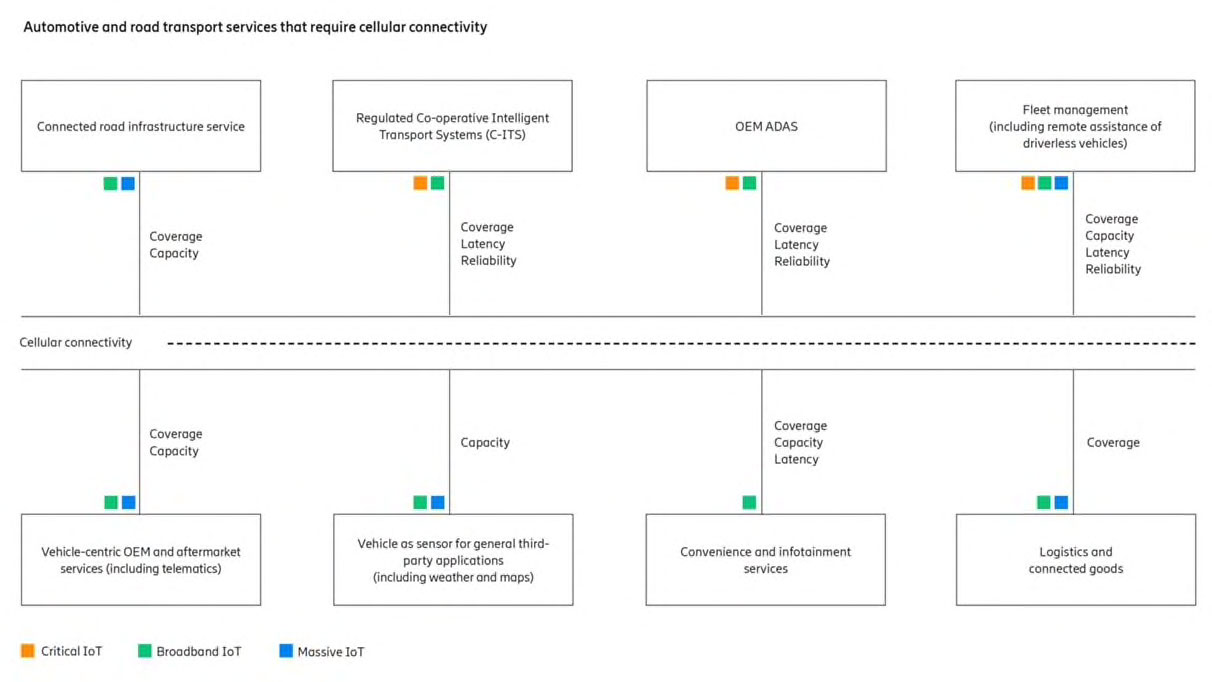

An array of automotive and road transport services requires cellular connectivity, with many already in commercial operation. These services can be classified into eight groups and mapped against the three cellular IoT technology segments – massive IoT, broadband IoT and Critical IoT – based on their connectivity requirements.

Massive IoT is suitable for low data rate use cases that can be supported with narrow bandwidth modems. These use cases can be found in logistics, telematics, fleet management and connecting parts of road infrastructure. Broadband IoT is vital for most automotive use cases that require high data rates and low latency, such as infotainment, telematics, fleet management, sensor sharing, basic safety and advanced driver assistance systems (ADAS).

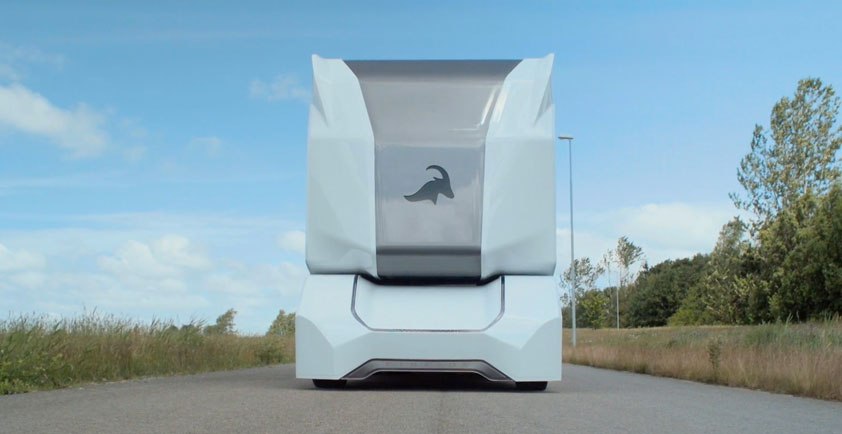

Critical IoT enables ultra-reliable and/or ultra-low latency communication and can provide some very advanced services, such as remote driving of automated commercial vehicles on specific routes.

4G (LTE) networks already support massive IoT (NB-IoT/Cat-M) and broadband IoT. 5G networks will boost broadband IoT performance and support ultra-reliable low-latency communication (URLLC) with critical IoT – enabling the full range of existing and emerging automotive applications. This horizontal approach of supporting all services through a common cellular network is much faster and more cost-efficient than deploying dedicated systems for different services.

Connected road infrastructure services, such as physical traffic guidance systems, parking management and dynamic traffic signs, are operated by cities and road authorities to monitor traffic and control its flow. Each service group contains multiple use cases, and requirements can be diverse within a group.

The ongoing roll-out of 5G provides a cost-efficient and feature-rich foundation for a horizontal multi-service network. The time-to-market for 5G networks and services is faster than for earlier generations, and connectivity capabilities can be tailored to different services using mechanisms that enable both separated QoS treatment and separated charging. This functionality contributes to making 5G instrumental in helping to maximize the safety, efficiency and sustainability of road transportation.

Regulated Cooperative-Intelligent Transport Systems (C-ITS) focus on government-regulated services for road safety and traffic efficiency. Traffic efficiency use cases have relaxed latency requirements, while safety-related data often requires reliable low-latency communication. A benefit of regulation is to encourage cross-OEM cooperation in standardized (regulated) information exchange. Regulated C-ITS services may also use dedicated ITS spectrum in certain regions; for example, for direct short-range communication using 3GPP PC5 or IEEE 802.11p technologies.

OEM ADAS aim to increase road safety by focusing on the driver and their driving behavior. They rely primarily on vehicle sensor information and are typically not collaborative across vehicle brands. ADAS services can also benefit from data provided by traffic authorities, such as traffic light information. They are expected to evolve to support the driverless vehicles of the future.

Fleet management services are aimed at vehicle fleet owners, such as logistics or car-sharing companies. The communication service is primarily used to monitor vehicle locations and the vehicle/driver status. If the fleet consists of driverless vehicles, fleet management also includes communication support for operations monitoring and remote assistance, which can imply full remote driving.

Vehicle-centric OEMs and aftermarket services focus on vehicle performance and usage. They make it possible for the OEM to collect vehicle diagnostics data that enables it to monitor and adjust the vehicle and give advice to the driver for improved driving efficiency. Other examples of services in this category include vehicle tracking and remote and predictive maintenance.

Vehicle-as-a-sensor for general third-party use cases involve the installation of sensors in the vehicle to provide information. Solutions aimed at achieving driving improvements (such as ADAS or automated driving) are reused to provide anonymized data to other parties to monitor city infrastructure and road status, maintain street maps or give accurate and up-to-date weather information.

Convenience and infotainment services deliver content such as traffic news and audio entertainment for drivers, and gaming and video entertainment for passengers.

Logistics and connected goods services have the primary focus of tracking transported objects (commodities, merchandise goods, cargo and so on) during the production and transport cycle of the object.